Vedant Fashions (Manyavar) - Providing "Poshak" for "Band, Baaja, Baaraat" (Part -1)

VFL is a strong company with enough growth runway. However, all that and beyond is captured in the current price

First thing first - this NOT an investment recommendation, and is purely for educational purpose. This will be a two part write-up

Key takeaways:

VFL has built a strong name over two decades in the Indian weddings and celebrations market, especially in the men’s category (Manyavar)

TAM is large and fragmented; industry is defensive. Organized companies like VFL have opportunity to grow at a rapid pace

The Company has competitive advantages which is apparent in the financial metrics across ROCE, ROE and free cash flows

While the growth momentum led by store expansion would continue, the margins appear to have peaked

The stock at the current level is fully-priced and upside potential is capped

I was going through recent IPOs (since 2021) which have done well i.e. both had an IPO pop and is trading above the pop price - in spite of market correction. Of the ~75 companies which got listed about ~15 satisfy this criteria - companies of different hues [will write more on performance (or non-performance) of IPOs in the coming weeks]. However, one name which stood out due to its strong operating metrics was Manyavar (Vedant Fashions - VFL). I will share my learning and views on the business.

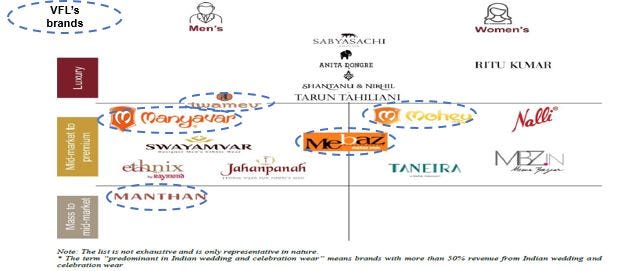

About the Company: VFL was founded in 1999 by Mr. Ravi Modi, a first generation entrepreneur. The Company caters to the Indian weddings and celebrations apparel market - primarily the wedding day clothings of groom and bride. Manyavar, launched in 1999, is VFL’s flagship brand for men’s category. It contributes 80-85% of the revenue. Mohey, launched in 2015, is for the women’s segment. Both Manyavar and Mohey are positioned as mid-market aspirational brands. For the men’s category, VFL has also launched brands, Twamev and Manthan, to target premium-luxury, and mass markets respectively. The Company is also focusing on families and friends of brides and grooms for their clothing needs. Further, it is also trying to attract brides and grooms for non-main events during the weddings - Indian weddings are multi-functions event. Additionally, the Company is also positioning itself to get a share of non-wedding ethnic wear market. Primary sales channel for the Company are EBOs (exclusive brand outlets) - contribute 90%+ of the revenue. VFL also sales through MBOs (multi-brand outlets), LFSs (large front stores) and online channels. To avoid brand dilution the Company does not sell Manthan (men mass market brand) at the EBOs. Further, Twamev (men premium market brand) is only available at EBOs. During 2017-18 period, VFL acquired Mebaz, a mid-market retailer catering to both women and men in AP/Telangana region.

In 2017, PE fund Kedaara invested in the Company; has existed now (appears to be a solid outcome for the fund; my estimate: 4-5x MOIC, 40-50% IRR).

Now let us look at some thesis and my views on the Company as an investment opportunity.

Large TAM (total addressable market): VFL is a retail play in a large Indian weddings and celebrations apparel market

Key findings of this sections:

Market is large: $1B+

Volume market size can grow only at the population growth rate - low single digit growth rate (~2%)

Value market size can grow at a slightly faster pace than volume market size - mid-single digit growth rate (4-5%) - driven by premiumization of the category and inflation led price increase

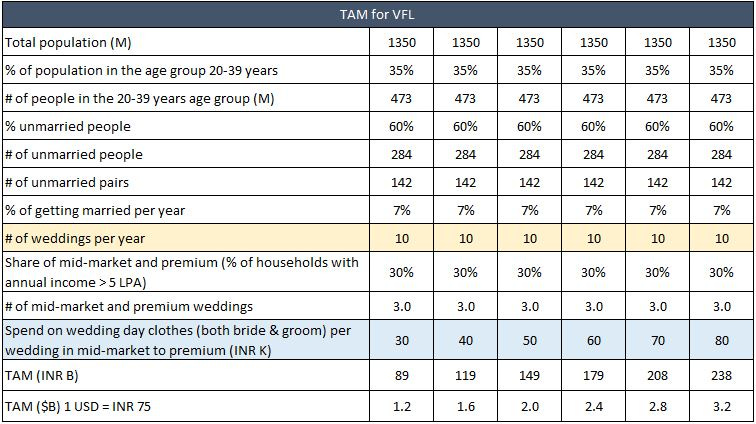

Is the market large enough? There are various approaches to market sizing.

Approach 1: Every year ~10M weddings take place in India. Of this we can assume 30% to be the target segment for VFL (households with annual income > INR 5 LPA). At an average spend of INR 30K per wedding (conservative estimate) on the combined clothing of the bride and the groom we arrive at a TAM of ~ INR 90B ($1.2B). A TAM of > $1B in the Indian context is pretty decent.

Approach 2: we can build additional upsides to this market size estimate: i) market expansion: through mass market brand Manthan, ii) increase in the basket size: sales to the bride and the groom for occasions other than the wedding day, iii) cross sell: to families and friends, and iv) new market opportunity: non-wedding ethnic wear market. If we factor in all these the TAM would increase by ~10x to ~INR 850B ($11B).

However, writing about upsides is easier, execution is tough and uncertain. The bottom-line is that TAM is large enough for an organized retail play.

Also please note that the market size of the men’s segment is 25-30% of the TAM; of the ~INR 90 B total TAM (at the lower end) men’s segment (strong area of VFL) is ~INR 25 B while women’s segment is ~INR 65 B. Overall, VFL has ~30% market share in the men’s category.

Market is unorganized, and characterized by poor customer experience - an opportunity for organized companies to gain share

Market share of organized retailers is estimated at 15-20% - opportunity of growth for the organized retailers like VFL. Further, women segment is relatively more fragmented as compared to the men’s segment.

Why I feel that the fragmented market can be an opportunity for organized retailers?

Wedding dresses are high involvement and high touch category. Customer experience, is extremely important, which most standalone retailers cannot provide because of: i) relatively small retail space and limited infrastructure such as lighting, change room, mirrors etc. and ii) lack of trained staff to guide the customer through the experience of selecting the dress

Design is the most important attribute in wedding clothes. Most standalone retailers do not have a formal design team to research and develop new designs

Organized retailers like VFL bring reliability and trust. Think of this in-line with Tanishq for jewellery which is also a high involvement category, is design driven, and requires trust

Further, one strong feature of the Indian weddings and celebrations industry is its extremely defensive nature, more than even some essential categories like food and regular apparel. For example due to Covid-19 led lock-down demand for other industries got destroyed for that period but for Indian weddings and celebrations industry it merely got pushed out.

Manufacturing and supply-chain is complex and difficult to replicate

Indian wedding clothes are not mass manufactured products. These are customized for design, and there is higher degree complexity, in sourcing, vendor handling and supply chain management, than other apparels. VFL has 20+ years of experience and add to the Company’s competitive advantages

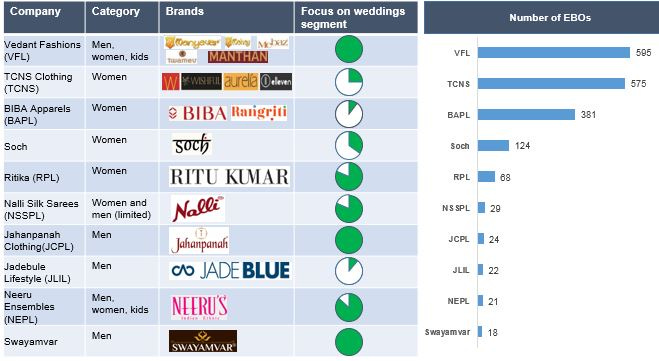

Limited competition from other organized retailers: VFL has a broad portfolio, and greater geographic footprint than competitors

VFL has brands catering to both men and women segments, and is a more focused player on the weddings market while most of its competitors are focused only on one gender or have generic ethnic wear focus. Further, VFL also has the highest number EBOs. EBOs are important to drive customer experience in high involvement categories: i) helps in creating brand identity, and ii) helps in carrying many design based SKUs.

Further, VFL has brands to cater to different market segments, while competitors are more niche focused.

Asset light model (across both front-end and back-end) helps reduce capital intensity

On the front-end, VFL’s EBOs are FOFO (franchise owned franchise operated) stores, and at the back-end VFL outsources significant portion of its manufacturing which lead to: i) lower capital expenditure, ii) lower operating expense, and iii) greater management bandwidth to focus on product development, marketing, and other strategic areas to drive growth.

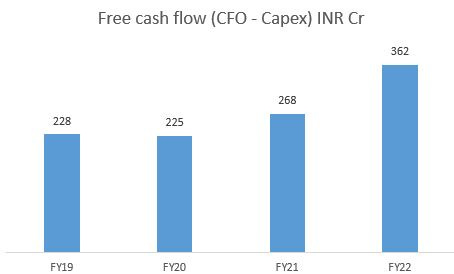

This is apparent with the FCF generation. The Company has done a cumulative capex of ~INR 50 Cr over the last 4 years. Note that there was FCF even during Covid-19 period. Further, gross block turnover is also good at ~2.5x (was higher in the pre-Covid-19 era). I will also discuss the return profiles (ROCE and ROE) in a later section.

Capex is one part of capital intensity, the other part is working capital. VFL is relatively weak on working capital. It has long working capital cycle (~4 months of net working capital days - NWC). The key driver of high net working capital days is receivables (~140 days). However, the Company takes deposits from franchisees, at the time store opening, which provides some cushion against the receivables. If we adjust for the deposits then the NWC would be closer to 100 days (still high).

VFL has strong balance sheet. It has INR 416 Cr cash & equivalents, and is debt free. Only financial liabilities are lease liabilities (INR 279 Cr) and franchisee deposits (INR 90 Cr). But the nature of these liabilities are not same as debt so far business operations are concerned.

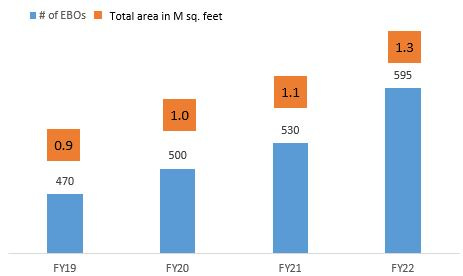

Growth to be driven by store expansion. SSSG (same store sales growth) can at best be in the mid-single digit

SSSG can at best be in the mid-single digit once a store matures (it takes about 2-3 years for a store to mature). Primarily, because every store caters to a catchment area and after that the store can grow only at the industry growth rate. In case of VFL, a 2-3 years old store would have INR 10-12K sales per sq. feet. Of the 595 EBOs, that the company has only ~15% are <2 years old, so to grow at a rate faster than the industry company needs to open up more stores. Management’s comments regarding SSSG are in line with this thought. VFL plans to expand store area from 1.3M sq. feet to 2.2M sq. feet over the next 4 years (~15% CAGR). Number of stores assuming average store size of 2500-3000 sq. feet would grow from the current 595 to 900-1000. These new stores would open in existing cities and new cities (management has identified 120-130 new cities). VFL has a track record of expanding stores at this pace in the past.

A case can made for slightly higher SSSG, from some levers: i) increase in basket size and cross-sell: sales to bride and groom for non-main events, sales to families and friends of brides and grooms, ii) up-sell: sale of premium brand Twamev, and iii) more aggressive expansion into non-wedding celebrations

Further, growth can also come from the growth of mass-market brand Manthan (available at MBOs and LFSs), and international expansion.

Key takeaway is that 15-20% revenue CAGR over the next 5 years is reasonable.

Low store and franchisee churn underline the sustainability of business model

Franchisee need to make money to continue their engagement with VFL. So far it appears to be working out well:

~300 franchisee with ~600 stores; store closing rate is ~4%

~75% of the franchisee have been working with VFL for >=3 years

~65% of franchisee owners have >=2 stores

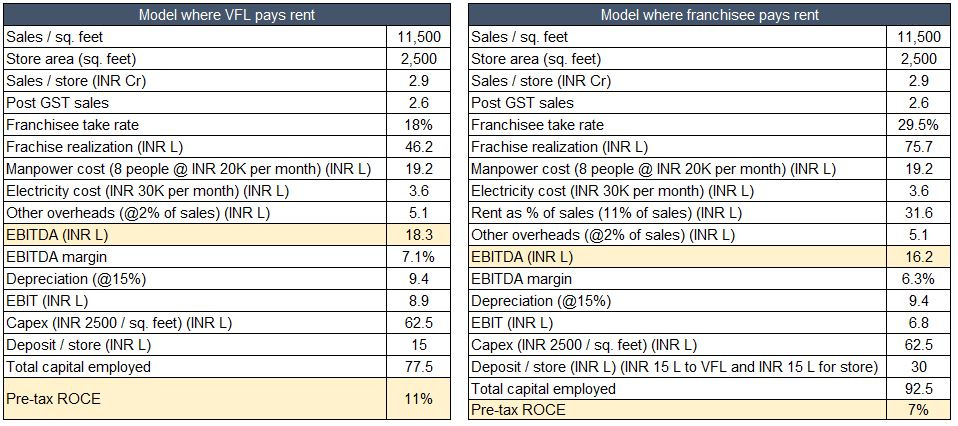

The Company has two models with franchisee:

VFL pays the lease and franchisee take rate is 18%

Frachisee pays lease and its take rate is 29.5%

60% of the franchisees operate on the first model. Please see below the estimates for the money that a mature franchisee owner would be making. These are conservative estimates - the returns would be better; per the management payback period for a franchisee owner is 3-3.5 years.

The skew is towards a model where VFL pays rent (60% cases) is because of poor return profile for the second case. This would be true especially for metro and tier 1 cities where franchisee would want VFL to bear the lease.

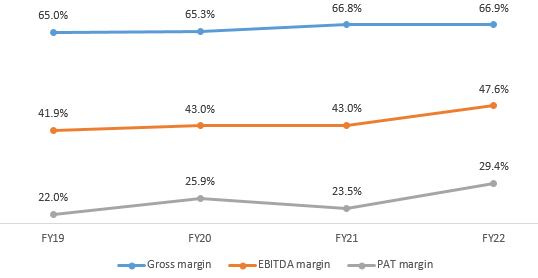

Strong return profiles: high margins and asset light model help drive strong ROCE and ROE. EPS growth has been strong as well

People tend to compare margins of various retailers. However, please note this comparison may be flawed due to different revenue and cost recognition methodologies across different companies. VFL operates FOFO model, and it nets out franchisee payouts from the revenue. This decreases the denominator and the margin appears high. Other companies (especially those with different store models such as COCO, COFO, FOCO, FICO etc.) may not be netting out franchisee payouts from the revenue, and could be recognizing it as a separate cost line. In such cases the margins would appear low. However the absolute value of EBITDA and PAT would not change. A generic example: INR 100 in sales, INR 10 payout to franchisee, and INR 20 in other operating expenses. In case of VFL the revenue is INR 90 and profit is INR 70 (90 - 20). So the profit margin would be 77.7% (70 / 90). However, if another company recognizes franchisee payout as a separate line item then revenue would be INR 100 and profit would still be INR 70 (100 - 10 - 20). Profit margin in this case will be 70% (70 / 100).

This is why we should look beyond margins and compare return ratios. VFL has strong return ratios - ROCE and ROE. Its current return ratios are better than the pre-Covid-19 returns of many retailers. EPS growth rate is also good.

Quality of promoters and management is decent. Top management consist people who have tenured within the Company

Ravi Modi, the Chariman & MD, is a first generation entrepreneur and has built VFL from scratch. Rahul Muraka is the CFO, and has been with the Company since 2013. He got promoted after the last CFO resigned in December 2020. Vedant Modi is the son of the promoters (Ravi Modi and Shilpi Modi) and has joined the business 2021. He is now Chief Marketing Officer. He is the face of VFL during analyst and investor calls. So far on the calls he has been good at answering questions and generally has hold over numbers.

Promoters have ~85% shareholding which is mostly good but also has its downside. Good because it shows that the promoters have significant skin in the game. Downside because there is too much control, and any dilution in stake by promoters in the future could be perceived negatively.

Further, non-promoter top management is well paid, and also has equity holding (as of September 2021) - some skin in the game.

The Company however has very high attrition rate. The attrition rate in FY19, FY20 and FY21 were 18%, 25% and 35% respectively. Very high number in FY21 could be due to Covid-19. However, the Company does not appear to pay its employees well. Average compensation excluding KMP is ~INR 4-5 LPA. If we exclude the salary of senior management level employees then the compensation would be even lower. This could be another reason for high attrition rate. Paying low salary is not strategy to build a profitable business. There is cost attached to attrition (hiring, training and productivity improvement). Overall, employee expense is 5-6% of the revenue which is lower than peers. I have negative bias about businesses which have very high attrition rate and below average employee expense.

A few other positives:

Management regularly talks about the Company’s strong IT infrastructure - helped automate sourcing, operations, supply chain, tracking inventory level in the real time, and also in capturing market insights which feeds into product development. According to VFL this has helped in minimizing dead stocks and stock-outs.

After going through the numbers I am not confident there if there is anything extraordinary. The gross value of IT related products is <2% (<INR 10 Cr) of the total gross block. Also, there is no line item which explicitly shows the expense on IT services and products

Having said this, the inventory management appears to be decent. ~75% of the total inventory is finished products (finished goods + stock in trade) which indicates well planned procurement of raw material, packing material, and also outsourced manufacturing. Further, there has been no material write-off of inventory in the last 4 years. The provision for return is also stable at INR 70-75 Cr (however, need to monitor this line item as it is based on management’s estimate). All these good things could be due to VFL’s well integrated IT infrastructure but could also be due to the nature of the industry

Another area that the management discusses often is its relationship with vendors for sourcing materials and outsourcing manufacturing. With more than 20 years of operations this function would be well built. VFL has 450+ vendors across 40+ cities in India

No red flags regarding the auditor. Auditor has not changed over the last few years and auditor’s fee has also not increased significantly. EY is the statutory auditor

Part 2 will cover risks and valuations. Link to Part 2

If you liked reading this piece, please share in your circle, it will encourage me to write more frequently. Also feel free to comment and critique.