Vedant Fashions (Manyavar) - Providing "Poshak" for "Band, Baaja, Baaraat" (Part -2)

VFL is a strong company with enough growth runway. However, all that and beyond is captured in the current price

First thing first - this NOT an investment recommendation, and is purely for educational purpose. This is part 2 of a two part write-up on VFL. Please read Part 1 here, which covers my thesis on VFL.

In this part I will focus on risks and valuations.

Industries with large TAM and attractive incumbent return profile attract competition

Currently, there is no pan India competitor. But going forward competition from more generic apparel companies like TCNS, ABFL, Raymond etc. can come. Further, the Company will continue to face regional competitors challenging it in certain pockets and geographies. However, VFL is ahead in the game with well set systems and processes at scale. As discussed in Part 1 manufacturing Indian weddings wear is a complex business and doing it at a scale is even tougher.

Need for continuous product innovation - designs and products get out of fashion quickly

VFL is not a brand play. It is a retail play with elements of brand. While VFL does not give discount on its flagship brands, it also does not raise the price much. An essential feature of brand, from an investor perspective, is its ability to generate producer surplus. Would customers be willing to pay if VFL increased its price by 15-20%? Do not think so; otherwise VFL would have taken regular price increase. Do people purchase Manyavar or Mohey for its name, the way they do with iPhone? Do not think so; people purchase clothes from VFL because the designs are good, quality is superior, and the shopping experience is better. When someone buys a jewellery from Titan/Tanishq they discuss about the product and its design, and not so much about Titan/Tanishq. Same with VFL’s Manyavar/Mohey. So, VFL continually needs to churn out vogue designs, and quality products.

Only Manyavar is well built. Other brands especially Mohey are in incubation phase

Manyavar contributes 80-85% to the total revenue. Mohey (catering to the women category), after 7 years of launch, is in incubation phase. Mohey’s segment constitutes 75-80% of the TAM, and has higher ATS (average ticket size). To drive high teens growth the Company needs to scale-up Mohey.

Peak margin profile: the Company has been operating in a very cost efficient manner posing risk to margins

Gross margin: The Company is already at ~67% GM which is historical high. Management comments indicate that it is not considering price increase. In such a scenario margins would at best remain flat but my thesis is that it could decline by a couple of percentage points over next few years

Other opex:

Salary expense: in Part 1 we discussed that employee cost for VFL is on the lower side. Employee cost could increase especially as the Company is planning to expand to new cities

Advertising and marketing expense: the Company had cut on the marketing expense during Covid-19. However, going forward, it should increase as VFL focuses on growth especially of the newer brands - Mohey and Twamev

Lease/rent expense: generally the leases would be for a long term with some periodic escalation built in. So there should not be material increase. However, for the new stores there could be higher rental cost per square feet due to macro factors like inflation and interest rates which slow down the supply of real estate

Other expenses are ~5% of the revenue. In Q4 FY22 and Q1 FY23 there could be some one-time expense towards IPO

EBITDA margin: high gross margin and low opex drive VFL’s high EBITDA margin which is also at historically highest level at ~48%

How do these narratives (about opportunities and risks) translate into numbers (valuation and investment opportunity)?

Let us do some very high level quick and dirty financial modelling to understand how the earnings and free cash flow can grow. We would also discounted cash flow valuation and discuss the trading multiples of peers.

As reasoned previously, there are reasons to believe that VFL can grow its topline at high-teens CAGR (18%) over the medium-term (5-7 years). For the purpose of simplicity let us assume it to be linear YoY (year on year) 18-20% growth

EBITDA margin however is at peak and could decline by 4-5% points in this time period. Over this time frame let us assume EBITDA margin to gradually decline and settle at 43%

It is reasonable to assume that VFL will continue to be capital efficient in terms of capex, and also improve its working capital modestly

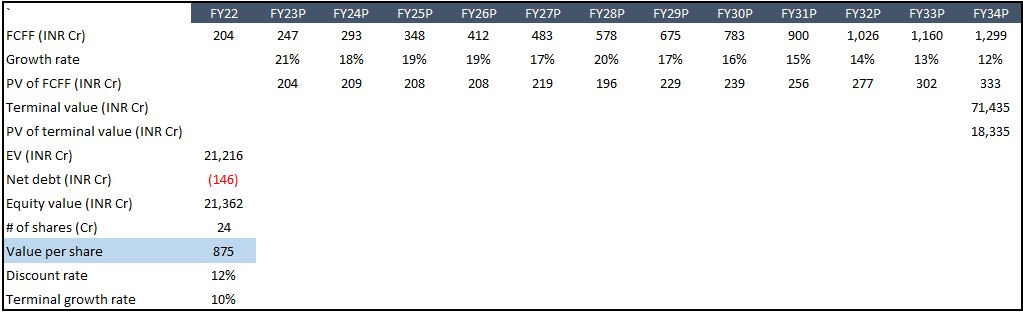

Overall, we can build a case for high teens FCFF CAGR for the next 7 years. After that we can gradually decrease the FCFF to 12% over the next 5 years, and terminal growth rate at 10%. Further, let us assume discount rate at 12% (low?)

We arrive at a value per share of INR 875 which is a 19% discount to the CMP (current market price) of INR 1082

But who knows the Company may continue to grow its cash flow at a much faster rate even beyond the 12th year. This is what the market appears to be believe

Value derived using DCF are very sensitive to terminal growth rate and discount rate

Let us also look at trading multiples of retail peers. For the reasons stated in Part 1, different revenue recognition methodologies across companies, we would not look at EV/Revenue, and only focus on EV/EBITDA and P/E.

VFL is trading at a discount to the median trailing multiples

However, on forward basis the Company is trading at premium - 41.1x EV/EBITDA of VFL vs. 36.8x median multiple. Further, 41.1x forward multiple VFL’s implie ~30% EBITDA growth over the next 1 year - looks a bit steep

The discount on trailing multiples could be because most retail companies got impacted more than VFL during the Covid-19 in FY22, and the market is discounting that as one-time event

Over a period of ~8 years (from May 2012 to Feb 2020 - Pre-Covid) the average LTM EV / EBITDA of Page Industries was ~60x

I do not think VFL has growth opportunity similar to that of Page’s. Over a period of 10 years (2010-2020) Page grew its revenue and EPS at ~25% CAGR. Further, its return ratios have also been phenomenal with average ROE during the period at 40-50%

Titan got re-rated in late 2017, and its average LTM EV/EBITDA from then until Pre-Covid period is ~50x. While Titan has also grown well but its growth has not been as consistent as that of Page

While VFL has strong growth potential, it is not same as that of Page or Titan. In my opinion it should trade at some discount to these two Companies

Bottom-line: stock appears to be fully priced and there is no margin of safety.

Other possible reason for VFL’s current valuation:

Float could also be a reason why the stock has done well even from the IPO pop level

~85% of the shares are held by promoters which would be in lock-in (I do not think promoters plan to sell post lock-in period but no way to tell). Further of the remaining ~15%, 14 mutual funds own ~8.4% (SBI MF is the largest holder with ~4.3%) and FPIs and AIFs together own ~4%. These are more long term investors and would not churn out a high quality stock so soon.

For comparison, promoters’ ownership in Page Industries is ~47% and there is no lock-in. For the remaining ~53% the ownership is very diversified. In Titan promoter ownership is ~53% with no lock-in, and a very diversified ownership for the remaining 47%. Avenue Supermarts (D-Mart) also lower promoter ownership then VFL at ~75%, and diversified ownership for the remaining ~25%.

To sum it up, VFL has created competitive advantage for itself in an attractive industry which is reflected in its financial metrics. However, at the current market price the upside appears to be limited. But I could be wrong and market could be seeing something which I am missing

If you liked reading the analysis (irrespective of whether you agree or disagree) please share; it encourages me to write more regularly.